Ticker: AVAP

Market capitalisation: £99 million

Share price: 147p / £1.47

Founded: 2006

Headquarters: 65 Kampong Bahru Road, Singapore 169370, Singapore

(Data accurate as of 02/05/2025)

Background

AVAP leases commercial passenger aircraft to airlines. Their 33 aircraft are leased to 15 different airlines across 13 different countries, including EasyJet (£EZJ), EVA Air, Philippine Airlines, Alliance Air India, VietJet Air, Fiji Airways, Mandarin Airlines, Cebu Pacific, airBaltic, Aerlink, PNG Air, and Braathens.

Some numbers

AVAP has a net asset value (NAV) per share of £2.94 (as of 31 December 2024), which against a share price of £1.47 is a 50% discount to NAV. Their assets include:

Their 33 aircraft. They may sell these where it makes business sense to do so, for example, AVAP sold an unutilised aircraft last year with Robert Chatfield – Executive Chairman – saying in the FY24 annual report: “Avation has recently focused on transitioning or disposing of unutilised aircraft, maintaining liquidity, managing costs and reducing leverage.”

Purchase rights for 24 ATR aircraft. Think of these as options or the right to buy specific planes if they so wish. Given aircraft supply-market-dynamics (which we will touch on below), these are valuable. AVAP has effectively and opportunistically monetised these previously, and then either obtained more purchase rights or used the capital for other purposes.

Equity in Philippine Airlines.

Source: FY2025 Half Year Results Presentation Slides

Because AVAP is headquartered in Singapore, it is able to benefit from a low 8% tax rate for leasing activities under the Singapore Aircraft Leasing Scheme (something the UK government would do well to copy, but that’s a topic for another day). This scheme is set to continue until April 2029.

AVAP’s debt is worth scrutinising as net debt represents 61% of total assets. This means that in a worst-case event, creditors would have claims on 61% of the AVAP’s assets. This means on paper AVAP is fairly leveraged when you take into account that most investors view 50% or lower as a favourable amount of leverage.

Notably, however, aircraft leasing is a capital-intensive industry, and participants tend to operate with higher leverage, typically of between 50% to 75%, and depending on the market environment, it is not uncommon to see more. What makes AVAP’s debt noteworthy is that it includes fairly expensive (8.25%) unsecured loan notes with a face value of $324m. The context being that during the COVID pandemic, when air travel was being hit hard, their biggest customer at the time, Virgin Australia, went into bankruptcy, which forced AVAP into taking on expensive debt. This debt is due on 30 October 2026.

As a starting point, AVAP’s yields from their aircraft (i.e. the income from the less against the aircraft’s book value) exceed the interest on debt. In fact, AVAP’s yields on lease aircraft are trending upwards, and their fleet is fully utilised. As will be touched on further below, market dynamics are now and in the near future for both leasing and aircraft sales. These means should the need arise AVAP can opportunistically sell aircraft to payback debt should the need arise.

Notably, AVAP has been proactive and has actively been paying down this debt at a discount where the opportunity arises. For example, in 2024 alone, AVAP saved $3.2m by re-purchasing discounted debt and making gains on early repaid debt. South Sea expects this to continue, and where it is commercially advantageous, AVAP may sell aircraft to do so.

Full aircraft utilisation, good leasing yields, and savvy aircraft sales will leave AVAP the space to address debt while creating value for shareholders.

Bread and butter

In addition to yields, for AVAP to make money from leasing, airlines need to want to lease AVAP’s aircraft. Ultimately, there are noteworthy factors when it comes to whether this happens

(1) There needs to be a demand for air travel from potential passengers.

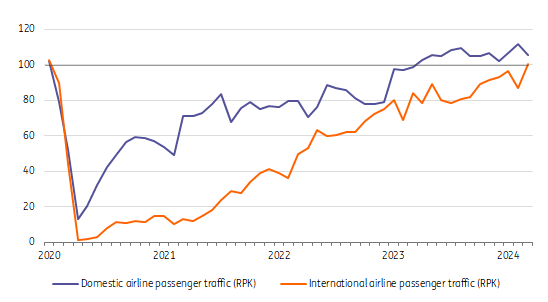

If an airline has no passengers, it doesn’t need any planes, so there is no need to lease them from AVAP. AVAP investors can rest easy for the time-being, as demand for air travel has been growing year on year since the back end of the COVID pandemic, with global passenger volume exceeding pre-pandemic levels in 2024.

Source: ING Research, IATA. Accessible here: https://think.ing.com/articles/operational-challenges-limit-the-altitude-as-solid-demand-continues/

This growing demand for air travel looks set to grow as more people globally start to become a part of the middle-class income group. Currently, about 10% of the global population is responsible for circa 90% of air travel traffic. This 10% are from middle to higher income groups, which suggests there is a correlation between income and air travel. From airlines’ perspectives, this is great news as they can sell tickets on planes, and from AVAP’s perspective, this is great news because they can lease planes to those airlines.

For completeness, there are several scenarios which would be bearish on this front for AVAP:

Another COVID-type scenario which causes a massive downturn in air travel. This cannot be completely discounted, but let us be frank, this would be a black swan event.

Government intervention seeking to restrict air travel. This is unlikely; and on the contrary, more and more state-backed air travel infrastructure (e.g. airports) are being built globally. Even the government of the United Kingdom - where it is normally difficult to get consent to build more infrastructure - has supported airport expansions for Bristol, London Gatwick, London Heathrow, London City Airport, London Stansted, London Luton, Manston, and Southampton. If anything, governments globally are helping air travel the trend.

(2) The supply of new commercial passenger aircraft should not outstrip the growth in demand for such aircraft.

Less supply means that AVAP can lease the aircraft it has out at higher rates and make higher margins per aircraft. Generally speaking, there is a shortage of aircraft due to (a) rising customer demand, (b) supply chain disruption, and (c) constrained plane production at Boeing due to safety concerns about their planes. It has been reported that the shortage will take years to overcome.

Activist involvement

Christopher DeMuth Jr and Jeremy Raper are well-known figures in the X.com investing community, and have proven themselves to be intelligent investors. In October 2023, it was disclosed in an RNS that they had invested in AVAP. Following the purchase, Raper stated on The Business Brew podcast (around the 44th minute) on November 2023:

“I've raised money, and entities I manage have taken a 20-something per cent stake in a listed aircraft leasing company in the UK called Avation, AVAP. This is all public. And you know my goal is to maximise value for all shareholders… I have a number of ideas to kind of create value for all shareholders…”

His comments above, reflect an alignment from him with other shareholders which is encouraging. (Btw It is well worth listening to the rest of the podcast to get a sense of Raper’s past successes as an activist.)

In February 2024 on the Money of Mine podcast (around the 55th minute mark, but again it is well worth listening to the rest of the podcast) Raper said:

“I am in concert with management with regard to strategy and value maximisation, so I can’t speak directly about that particular situation I’m afraid.”

This indicates Raper has actively tried to create value in AVAP. As of January 2025, DeMuth Jr held 15.94% and Raper held 0.2% of shares, and Raper indicated is still bullish on AVAP, with him saying in February 2025 on X.com:

“I assume if stock doesn't rerate this year you just see further asset sales and buybacks (PAL shares definitely, widebodies probably?). Yes I have a yuuge position so take it w/ a grain of salt. But still really like this one, especially as aircraft shortage doesn't seem likely to end for another few years, maybe 5+ years.” See full thread here.

The statements from Raper above suggest that if the discount to NAV does not close, then Raper and DeMuth will seek to close the discount through lobbying. South Sea suspects this may take the form of pushing for either:

Buybacks,

The sale of assets to either pay back debt or for further buybacks, or

The sale of AVAP to a bigger lessor.

DeMuth and Raper’s investment and potential activism down the road are not the reason South Sea is bullish on AVAP, but their involvement and comments strengthens the investment case as there are indications that they will help push for value creation if it does not happen organically in the medium-term.

Thesis

Here is South Sea’s thesis:

Increasing demand for air travel will result in AVAP’s aircraft fleet maintaining full utilisation on favourable yields on leases;

Management will also have the option of selling aircraft and purchase rights at attractive valuations to other market participants due to the high demand;

The proceeds of the aforesaid favourable lease yields and from selling planes may result in a re-rating of the stock, thereby narrowing the discount to NAV;

If no re-rating occurs, management of their own accord may choose to use proceeds to repay debt, or accelerate share buybacks to narrow the NAV discount; and

If management fail to do this of their own accord, shareholders such as DeMuth, Raper, and others could lobby for value accretive actions from management.

Conclusion

AVAP is attractively priced given it is trading at a steep discount to NAV, and is benefiting from tailwinds in the air travel sector. A re-rating or value accretive actions are likely to happen in the medium term; in the meantime, the NAV discount offers a margin of safety. There’s a lot to like here.

Other write-ups

East 72 Dynasty Trust’s Avation PLC: a niche within a trillion-dollar industry residing outside public markets for the quarter ended March 2025.

The Oak Bloke’s Standing Avation from February 2025.

The Oak Bloke’s AVAP - Avation - OB Idea #11 from December 2024.

The Oak Bloke’s AVAP... coz when you gotta go you gotta go from September 2024.

Rodin Capital’s Short Memo on Avation Plc from January 2024.

Special Situation Investments’ Quick Pitch: Avation (AVAP:L) from December 2023.

No Deep Dives’ Quick Pitch from November 2023.